Infos > Learn

Basel III

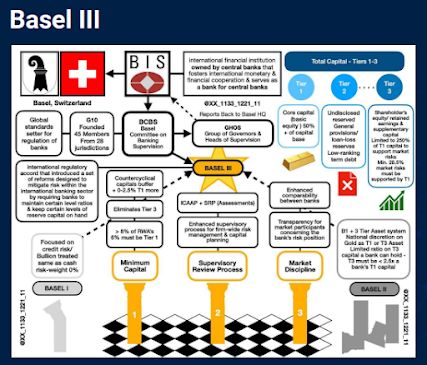

Basel III

- A worldwide standard that enhances international banking regulation structure, greatly improving risk management and promoting transparency

- Gold moving from asset tier 3 to tier 1, which allows physical gold in bars form to be accounted for at 100% of the amount for booking purposes

- Due to the 2007-2009 financial meltdown, Basel III was introduced

- International regulatory framework for banks

- Deadline on June 28, 2021

- The requirement that banks maintain a minimum capital value of 7% in reserve

- Require banks to hold unencumbered physical gold valued at 100%

- This will make banks less profitable as they will no longer be able to make money about the interest rate